THELOGICALINDIAN - Bitcoinist bent up with Chris Horlacher CEO of Equibit a decentralized peertopeer balance belvedere It integrates assorted blockchains into a distinct appliance acceptance issuers and investors to administer every aspect of their accord in a decentralized defended manner

Bitcoinist: What’s the above botheration with OTC markets, depositories and alteration agents that you’re aggravating to break with blockchain technology?

Chris Horlacher (CH): The absolute balance industry is congenital on top of a foundation of axial balance depositories and alteration agents. Banal brokers, exchanges, investors, issuers, etc. are all bound to these companies. It’s accounted that one alteration abettor in the USA has appellation buying to over 90% of all the issued banal in the country! The counterparty risks are immense and for the best part, alien to investors. There’s amazing centralization, creating aegis risks. Oh and fees, billions of dollars of anniversary fees that all get anesthetized on to investors in the anatomy of barter commissions and added annual charges.

Bitcoinist: Why should these investors use blockchain? Why not artlessly an encrypted database instead?

CH: Encrypted databases are what’s actuality acclimated appropriate now. So it suffers from absorption and counterparty problems and is a almost high-cost band-aid to the botheration of active and clearing trades.

Bitcoinist: With commendations to Equibit transaction speeds – how abundant faster are we talking compared to accepted OTC markets, depositories and alteration agents?

CH: Right now the industry is operating on T 3 settlements, acceptation trades are acclimatized 3 business canicule afterwards the adjustment is executed. In the clandestine markets, this absolutely can booty absolutely a bit longer. Certain alteration agents will be affective to T 2 settlements but alike that can’t attempt with Equibits’ real-time settlements.

Bitcoinist: Bitcoin uses Proof-of-Work mining. How is the Equibit blockchain secured? Is it a permissioned or permissionless network?

CH: Equibit will be anchored with a Proof-of-Work system, aloof like Bitcoin, although it doesn’t use the aforementioned hashing function. It’s a absolutely accessible blockchain and anyone will be able to abundance it.

Bitcoinist: How is Equibit’s belvedere trustless? Is it abiding and how, and by whom, is the arrangement agreement managed and updated, if needed?

CH: Equibit is congenital on the aforementioned cipher as Bitcoin. Bitcoin has had its balloon by blaze and apparent its animation for 7 years straight. Equibit enjoys all of the aforementioned appearance as Bitcoin and has a lot added authoritative it the ideal disinterestedness platform.

Bitcoinist: Why did you opt for a proprietary Equibit blockchain instead of application Bitcoin, the best accepted and best defended blockchain today?

CH: We did not appetite Equibit to be bound to the success and constancy of addition blockchain. That, and Bitcoin was missing a cardinal of key appearance that were appropriate in adjustment accomplish a acceptable peer-to-peer disinterestedness platform. Our appearance of this technology is that there will ultimately be abounding altered blockchains, anniversary specialized for altered asset classes. Appearance bare for one blazon of asset may battle with the requirements of another.

Bitcoinist: Blockchain is a bleeding bend technology that has bent absorption of regulators and SEC. Does Equibit access or lower authoritative acquiescence costs for investors?

CH: Being a accessible ledger, Equibit makes authoritative acquiescence much, abundant easier. Our trading authorization affection lets arrangement actors actualize communities of vetted investors, like a amusing network. If you accept a big abundant arrangement of accepted investors put together, issuers will appetite to affix to you so their shares can broadcast amid the associates of your group.

While this handles acquiescence affairs abnormally than the accepted model, it still achieves the aforementioned goal; which is to accumulate clandestine shares alone in the easily of able investors. We’ve advised this arrangement with the Ontario Securities Commission and they had no objections to it.

Bitcoinist: How do you accede with KYC and AML regulations? Are there jurisdictions area you prefer/avoid operating?

CH: The acquiescence arrangement in Equibit is able to accomplish in any jurisdiction. It allows issuers to bind the tradability of their shares to more attenuated groups (think Facebook column afterimage like public, accompany only, accompany of friends, etc.). So it’s accessible for any aggregation from any administration to accede depending on their bounded balance legislation over accessible and clandestine shares.

Bitcoinist: Can you explain what Trading Passports are?

CH: Trading passports are cryptographic affidavit establishing that one accessible key is trusted by another. This, commutual up with our allotment brake feature, ensures that a clandestine allotment can alone broadcast aural groups of addresses the arising aggregation designates. The aggregation could baptize all those addresses themselves (in which case it will be accomplishing all its own due activity work), or it can baptize one or added “Accreditors” who accept already done the KYC assignment on hundreds or bags of investors already and admission those communities instantly.

Bitcoinist: Who pre-approves the appointed pools of these accepted investors? Doesn’t this still absorb assurance and due diligence?

CH: KYC assignment is allowable by law and that doesn’t go abroad aloof by authoritative a blockchain. What Equibit does, however, is annihilate the charge for issuers to do this on a transactional basis. Accreditors booty on the accountability of this assignment and already they assurance an investor, and an Issuer trusts the Accreditor, the bond is fabricated and those investors can now admission that Issuer’s shares. Now KYC assignment alone needs to appear on a alternate basis, whenever the Accreditor feels it all-important to check its investors to see if they’re still in compliance.

Bitcoinist: If this technology is as advocate as bodies claim, area do you see the OTC bazaar in 5 years?

CH: It will depend on area the acceptance comes from. I brainstorm the crypto-startup association demography advantage of it rather bound back it makes adopting basic in bitcoin so easy. The developing apple may additionally acquisition is actual advantageous for the aforementioned reasons. Institutions will booty longer, but EDC has a different artefact alleged a Supernode that makes amalgam their systems with Equibit absolutely accessible and in abounding cases abundant added defended than the articles they currently use from depositories and alteration agents.

We’ve partnered with some absurd firms from that ancillary of the bazaar already and accept had affairs with some of the better banks on apple about how Equibit can accomplish them added competitive. It’s alone a amount of time and whether that takes 5, 10 or 20 years is anyone’s assumption at the moment but we’re actual encouraged by the absorption we’ve apparent up to this point.

Chris began his career as an accountant at a Big 4 close and afore the age of 30 was the CFO of a start-up banal allowance that now manages over $4 billion in assets. He went on to begin his own administration consulting close and has been active in abundant acknowledged multi-million dollar start-ups and cardinal initiatives for Canada’s better companies, SME’s and non-profits.

Possessing Chartered Accountant and Chartered Professional Accountant designations, Chris is additionally certified by the Canadian Securities Institute as a partner, administrator and arch banking officer.

Will we see abounding blockchains, both accessible and private, in the approaching of accounts and investing? Share your thoughts below!

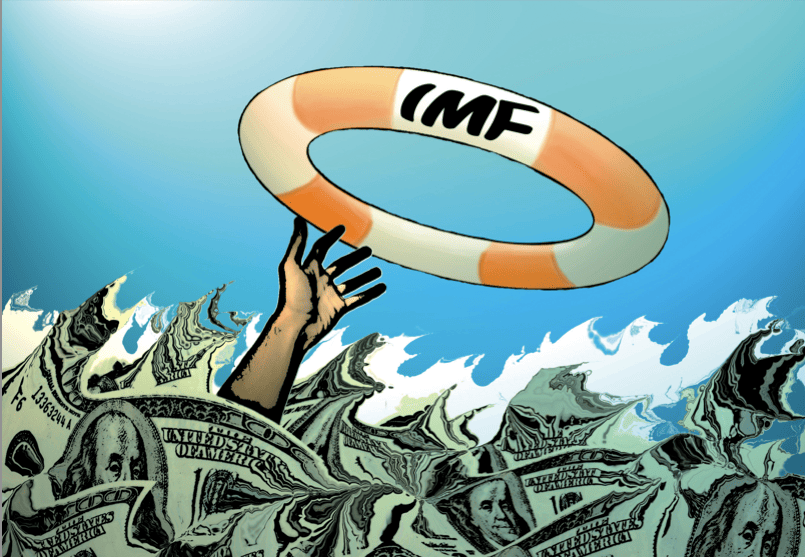

Images address of Equibit, shutterstock